Mastering the Basics of Personal Finance

Mastering the basics of personal finance is essential for achieving financial stability and long-term success. Learn key strategies today.

Understanding Income and Expenses

Mastering personal finance begins with a clear understanding of your income and expenses. Income encompasses all the money you receive, whether from a job, business, investments, or other sources. On the other hand, expenses include everything you spend money on, such as rent, utilities, groceries, and entertainment. To gain control over your finances, start by tracking your income and expenses meticulously. Use tools like spreadsheets or budgeting apps to record every transaction. This practice not only helps you see where your money is going but also identifies areas where you can cut costs. By distinguishing between needs and wants, you can prioritize your spending and ensure that you live within your means.

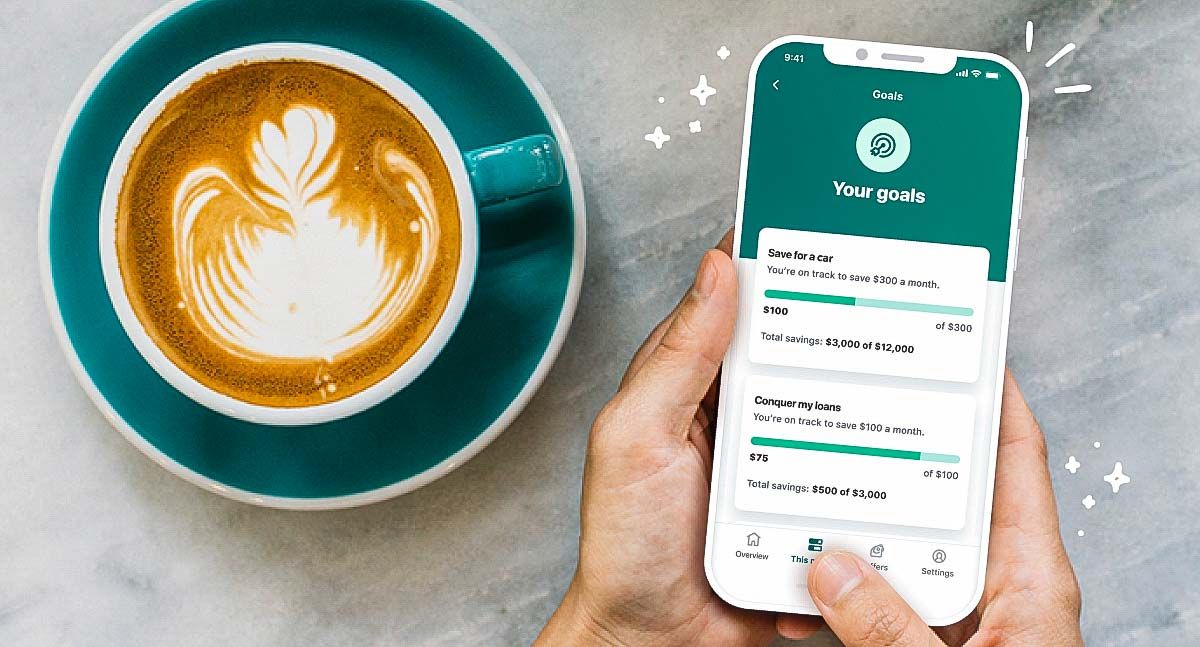

The Importance of Budgeting

Creating a budget is a fundamental step in personal finance management. A budget is essentially a financial plan that outlines your expected income and expenses over a certain period. It helps you allocate your resources efficiently and avoid overspending. Start by listing all your sources of income and then categorize your expenses into fixed and variable costs. Fixed costs are consistent monthly expenses like rent or mortgage payments, while variable costs fluctuate, such as dining out or entertainment. Once you have a clear picture, set spending limits for each category. Sticking to a budget requires discipline, but the benefits, such as reduced financial stress and increased savings, make it worthwhile.

Building an Emergency Fund

An emergency fund is a crucial component of personal finance that provides a financial cushion in times of unexpected expenses, such as medical emergencies or job loss. Aim to save at least three to six months' worth of living expenses in a separate, easily accessible account. Building an emergency fund may seem daunting, but start small by setting aside a portion of your income each month. Automating your savings can make this process easier. Having an emergency fund not only offers peace of mind but also prevents you from relying on high-interest credit options in times of crisis. It's an essential step towards achieving financial stability and resilience.

Managing Debt Wisely

Debt can be a significant obstacle in personal finance if not managed wisely. Start by understanding the different types of debt, such as secured and unsecured loans, and their respective interest rates. High-interest debt, like credit card balances, should be prioritized for repayment to minimize interest costs. Develop a debt repayment strategy, such as the debt snowball or debt avalanche method. The debt snowball method involves paying off the smallest balances first to gain momentum, while the debt avalanche method focuses on paying off the highest interest rates first to save money in the long run. Whichever method you choose, consistency and commitment are key to becoming debt-free.

Investing for the Future

Investing is a powerful way to grow your wealth over time. Begin by educating yourself on the basics of investment options such as stocks, bonds, mutual funds, and real estate. Each investment type carries different levels of risk and potential returns. Diversifying your investment portfolio can help mitigate risks. Consider your financial goals, risk tolerance, and time horizon when making investment decisions. Start with a small amount and gradually increase your investments as you become more comfortable. Remember, investing is a long-term strategy, and it's essential to stay informed and patient. Consistent, informed investing can significantly enhance your financial future.

The Role of Financial Education

Continuous financial education is vital for mastering personal finance. The financial landscape is constantly evolving, with new tools, strategies, and regulations emerging regularly. Staying informed through books, online courses, seminars, and financial news can help you make better financial decisions. Additionally, seeking advice from financial advisors can provide personalized insights and strategies tailored to your situation. Financial literacy empowers you to take control of your financial destiny, avoid common pitfalls, and capitalize on opportunities. Make it a habit to regularly update your knowledge and skills in personal finance to ensure you remain on a path towards financial success.